SBA Restaurant Revitalization Grants: Everything You Need to Know to Apply

Restaurant Revitalization grant applications open today at Noon EDT.

The grants will come from the Restaurant Revitalization Fund — the $28.6 billion fund that’s part of the broader $1.9 trillion American Rescue Plan Act that passed through the government in March 2021. The government-operated Small Business Administration agency is solely responsible for issuing grants from the fund.

The fund will go quick. For reference, the first $349 billion of PPP funds were depleted in under two weeks last year.

There’s been much already written about Restaurant Revitalization Fund details and qualifications. We’re doing our best to consolidate what we know now, update as new info is released, and link out to all action items you need to apply for and maximize your SBA Restaurant Revitalization grant.

Continue reading to learn more about the Restaurant Revitalization grant process. Reach out to our restaurant accounting expert with any questions about the application or eligibility. And take some time to explore xtraCHEF. The relief is sweet, but it’s no long-term solution for manually managed invoices, seemingly uncontrollable food costs, or a lack of actionable data. We fix these problems and more, and we’re happy to help you!

-

Tell me the Restaurant Revitalization Fund essentials

-

Am I eligible for a Restaurant Revitalization grant?

-

What documents and numbers do I need for applying?

-

How do I apply for my SBA Restaurant Revitalization grant?

-

When will I get my grant money?

-

How much can I expect?

-

Everything else we know about the RRF grants

-

xtraCHEF grants restaurants long-term operational benefits

If you're struggling to understand the RRF grant process, having issues with a lingering PPP loan, or simply need help getting your numbers in order, we'd be happy to connect you with restaurant accounting help!

Tell me the Restaurant Revitalization Fund essentials

- Grant applications open TODAY, May 3, at Noon EDT – Apply through the SBA portal, via SBA POS partners Toast, Square, NCR, and Clover, or by calling 844-279-8898

- These are tax-excluded grants, meaning you have nothing to pay back nor taxes to incur

- All expenses paid with grant proceeds are deductible for federal tax purposes

- Grants range from over $1000 to no more than $5 million per location with a $10M max

- Only businesses with 20 or fewer locations are eligible

- First 21 days of program is prioritized for businesses 51%+ owned by women, veterans, or socially and economically disadvantaged individuals

Am I eligible for a Restaurant Revitalization grant?

Here’s the quick facts – you are eligible to receive an SBA Restaurant Revitalization Grant as long as the following are all true:

- On-site food and beverage sales compromised at least 33% of gross receipts in 2019 or projected the same if your business opened in 2020

- Your business never permanently closed

- You have 20 or fewer locations as of 03/13/2020

- You did not apply nor were not denied for Shuttered Venues relief

- You have a valid business tax identification number (EIN, SSN, ITIN)

- You have not filed for bankruptcy with your business (or you’re operating under an approved plan of reorganization)

- You’re listed in the SBA Franchise Directory if a franchise identifier code

There’s finally some real relief available for restaurants and adjacent industries such as breweries, wineries, and most any business where the public assembles to consume food and drink – as long as on-site sales comprise at least 33% of total sales.

The grant opportunity is especially sweet if you opened in 2020. You are now an “eligible entity” for some government relief in light of all you, your staff, and your business have endured.

What documents and numbers do I need for applying?

Here’s the quick facts – you need to complete and submit the following documents to successfully apply for a SBA Restaurant Revitalization Grant:

- The official application (SBA Form 3172); here’s a sample application so you know what exactly you need, but this will need to be complete/submitted online

- Tax information verification via IRS Form 4506-T

- Any of these documents showing gross receipts and/or eligible expenses:

- Business tax returns (IRS Form 1120 or IRS Form 1120-S)

- IRS Form1040 Schedule C; IRS Form 1040 Schedule F

- Partnerships IRS Form 1065 (including K-1s)

- Bank statements

- Externally or internally prepared financial statements such as Income Statements or Profit and Loss Statements

- Point of sale report(s), including IRS Form 1099-K

How do I apply for my SBA Restaurant Revitalization grant?

Here’s the quick facts – you have three options for completing and submitting your application:

- The SBA has partnered with four POS systems, allowing their users to apply directly through their POS account and assumedly pulling all the required documentation and numbers contained within the system. These POS systems are: Toast, Square, Clover, and NCR.

- You can login or create a new SBA account and complete, upload, and submit your application and documents directly through the SBA Restaurant Revitalization Grants portal. Once completed, you’ll receive a DocuSign package via email. You will need to e-sign where required within that package. After signatures, the SBA will begin reviewing your application. They’ve stated that it will take approximately 14 days to review. You can check the status of your application in the same online portal you applied through.

- After assembling all the required documentation, you can call the SBA grant hotline at 844-279-8898. You’ll complete an application questionnaire and confirm proof of identity with a SBA support agent. You will then be mailed your completed application that you must notarize and send back to the SBA. They’ll include return address and other info. Upon receipt, the SBA will review your application. Just like submitting online, they’re estimated a 14-day turnaround to review.

When will I get my grant money?

Here’s the quick facts – when you get your grant money depends on a few factors:

- Do you qualify for the 21-day priority period? If your business is majority-owned by women, veterans, or socially or economically disadvantaged individuals, you can apply and expect to see movement on your review quickly. If your business doesn’t qualify for the priority period, you can still apply but won’t see movement with your review until after the 21-day period.

- How are you applying? Of the three application avenues described above, it’s seeming like applying through the partnered POS systems may expedite the review/turnaround process.

We’re reading between the tea leaves here, but the SBA explicitly states they’re approximating a 14-day turnaround time for online and phone submissions. They don’t state that same timeframe for submissions via the POS partners. If you’re fortunate enough to use Toast, Square, Clover, or NCR, you seem to be best served applying through that platform.

The SBA has given an open invite for additional POS partners, so be sure to check if your platform is offering application services before going online or picking up the phone (we’ll be updating this piece to reflect any new POS systems that have joined on.)

In terms of the 21-day prioritization period, the SBA defines the following:

- Socially disadvantaged individuals are those who have been subjected to racial or ethnic prejudice or cultural bias because of their identity as a member of a group without regard to their individual qualities.

- Economically disadvantaged individuals are those socially disadvantaged individuals whose ability to compete in the free enterprise system has been impaired due to diminished capital and credit opportunities as compared to others in the same business area who are not socially disadvantaged.

If either of these are true for you, or your business is majority-owned by women or veterans, you just need to “self-certify” on the application that you meet the requirements of the prioritization period.

How much can I expect?

Here’s the quick facts – you can basically expect to receive the difference in sales between 2019 and 2020 or the difference in expenses and sales if you opened in 2020.

The SBA has released three ways to calculate your grant amount. Each accommodates businesses that were open prior to 2019, opened in 2019, or opened in 2020. They roughly breakdown as follows:

- Calculation 1 is for businesses operating prior to 2019. You’ll essentially take the difference between 2019 sales and 2020 sales, less any PPP loans you received, and uses that as an estimate.

- Calculation 2 is for businesses that opened in 2019. It’s the same as the first, you simply need to annualize your 2019 sales and then subtract 2020 sales.

- Calculation 3 considers businesses that began operating in 2020. You’re going to take your 2020 expenses (between 02/15/2020 and 03/11/2021) and subtract sales over that same period.

Toast has put together a handy calculator to help you estimate the amount of your Restaurant Revitalization grant. It will at least give you a ballpark within which you can manage expectations.

Grant amounts will be reduced by the amount of any first draw and second draw PPP loans you received in 2020 or 2021. And if your calculations return more than $5 million per physical location, you’ll need to reduce the amount to $5 million per physical location and understand that the max grant will be $10 million. If the total is less than $1,000, you are not eligible.

Everything else we know about the RFF grants

The SBA will reserve portions of the $28.6B fund to ensure grants flow to specifically targeted restaurant segments. So far, these three “tranches” include:

- $5 billion for food businesses earning not more than $500,000 per year

- $4 billion to mid-sized venues taking in $501,000 to $1.5 million annually

- $500 million to establishments making under $50,000

Your grant can be used for most all business expenses (explicitly excluding independent contractors) up until March 2023.

xtraCHEF grants restaurants long-term operational benefits

There’s no denying the positive impact and general goodness of the SBA’s Restaurant Revitalization grant program. You deserve some relief for making it this far!

But what’s going to get you to May 2022? Get you that next location? Get you home to see your family and friends? Probably won’t be a well-deserved but one-off grant.

xtraCHEF will get you there.

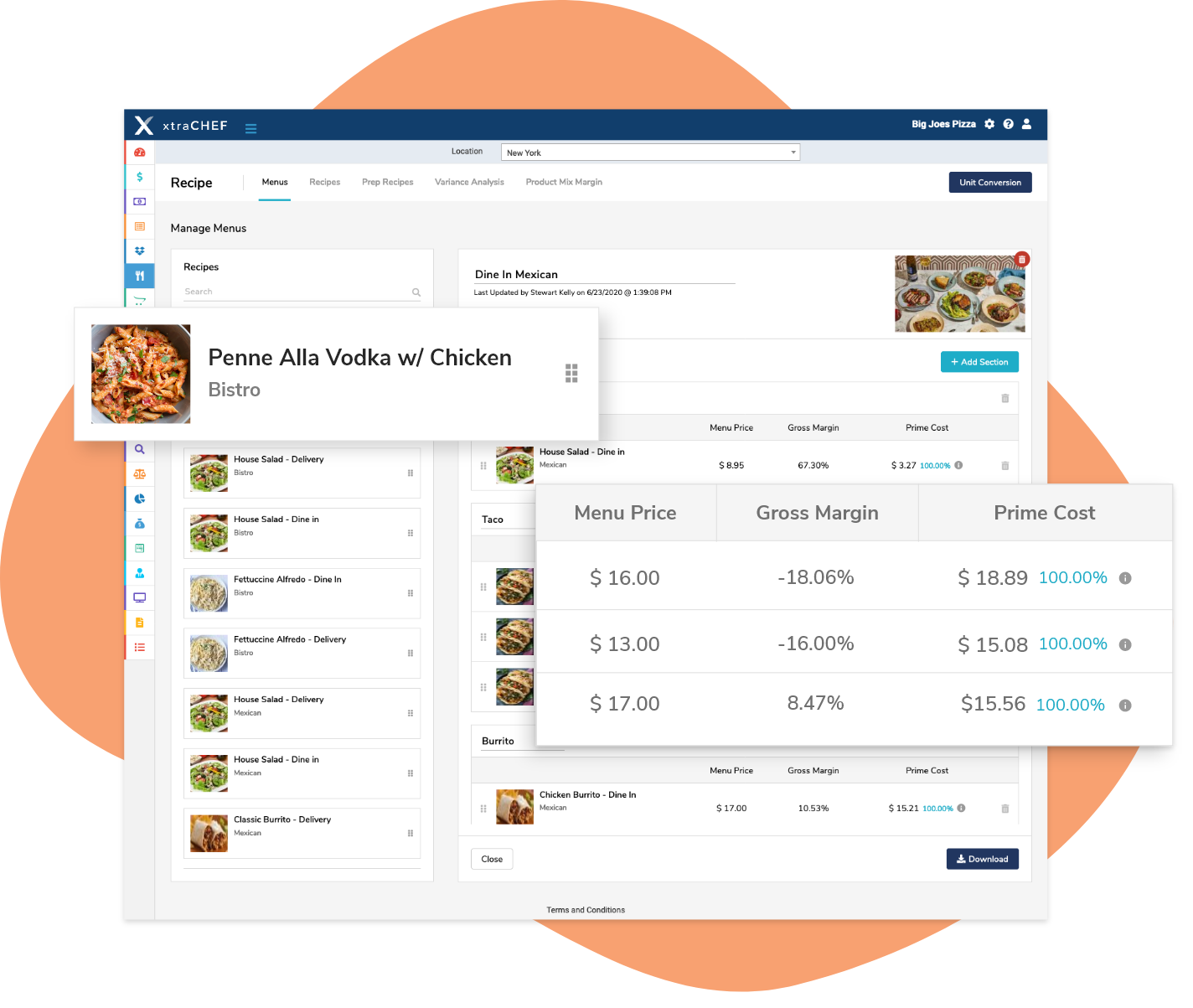

We’ve built a proven platform that provides a solid operational foundation, empowering owners, operators, accounts, and you to:

- Optimize your invoice and AP processes for newfound accuracy and efficiency

- Monitor and control food costs and vendor prices to avoid surprises

- Reach a lean inventory that frees up capital for reinvestment

- Manage recipe costs to maintain ideal margins

- Identify actionable, data-driven insights to achieve sustainable growth

If you’re interested, we’d be delighted to show you exactly how are suite of restaurant tools keeps profits in your pocket and gives you time back in your day.

Let xtraCHEF do your dirty work.

See how our platform sets restaurants of all sizes and service levels up for success by scheduling a demo with a Product Specialist.